2024-03-30

Embedding Municipal Green Bonds in Mexico City’s Hydrosocial Cycle: ‘Green’ Debt and Climate Action Narratives

Héctor Herrera

Abstract

Mexico City's municipal "green" bonds (MGBs), issued in 2016 and 2018, financed two water infrastructure projects embedded in the city's hydrosocial cycle (the reciprocal transformation of water and society). The issuance of the MGBs created an entanglement of "green" debt and water circulation, which the city government touted as a successful "green" intervention for climate action. However, this article argues that the MGBs also masked climate injustices and colonial legacies that were already prevalent in Mexico City's water circulation infrastructure, affecting aspects including socio-economic and gender issues. To substantiate this claim, this article adopts climate coloniality and climate justice as analytical lenses and urban political ecology as a methodology to critically examine the "green" label epistemologies and climate action narratives that justify the issuance of MGBs linked to water infrastructure projects.

Key Words: Climate Coloniality; Climate Justice; Urban Political Ecology; Green Bonds; Municipal Bonds; Mexico City

1. Introduction

Municipal “green” [2] bonds (MGBs) are debt instruments issued by subnational governmental entities, such as municipalities or city authorities. These bonds are labeled “green” to signal to the financial market that they are linked to environmental and climate change adaptation and mitigation projects (Climate Bonds Initiative [CBI], 2020). MGBs have been promoted as a climate finance option to raise non-concessional loans (debts) from financial markets. This stands as an alternative to other sources of liquidity, including non-concessional loans from commercial banks, concessional loans from development banks, or grants from climate funds (OECD, 2022).

Climate finance encompasses a spectrum of financial resources, including public, private, and other funds, classified as mechanisms to support climate change mitigation and adaptation (United Nations Climate Change, n.d.). Adopting a climate justice and climate coloniality approach, this article comprehensively explores MGBs as a debt-based climate finance instrument for water infrastructure projects, recognizing water as a crucial environmental and climate element. This exploration provides insights into the dynamics and narratives surrounding capital and environmental redistribution with regard to water.

Since 2007, “green” bonds have been circulating capital globally, becoming a relevant component of the climate finance landscape (Bracking, 2019; Bracking & Leffel, 2021). Notably, this climate finance instrument has demonstrated the capacity to mobilize substantial amounts of capital, surpassing other instruments, such as the Clean Development Mechanism [3] and the Green Climate Fund. [4] The “green” bond market achieved a milestone in 2020, reaching a cumulative issuance of US$1 trillion (BloombergNEF, 2020).

Since 2014, both private and public actors in Latin America, such as corporations and municipal governments, have issued “green” bonds to finance climate and environmental projects, particularly water infrastructure (Mejía-Escobar, González-Ruiz, & Franco-Sepúlveda, 2021). As of 2022, a total of five MGBs have been issued in this region: two by Mexico City, as extensively analyzed in this article, two in 2017 by Argentina’s La Rioja (Economic Commission for Latin America and the Caribbean, 2017) and Jujuy (Sustainalytics, 2017) provinces, and one in 2022 by the Argentinian municipality of Córdoba (Córdoba Capital, 2022).

Mexico City’s MGBs are of particular interest, since they were pioneers of the municipal “green” debt market in Latin America. Importantly, the bond proceeds were directed toward water infrastructure, an essential component of the hydrosocial cycle, which is the reciprocal transformation of water and society across time and space. Motivated by this observation, the research underlying this study was driven by the following question: How do Mexico City’s MGBs intersect with the hydrosocial cycle of the city, especially in the context of prevailing local disparities in water distribution? Employing the analytical frameworks of climate coloniality and climate justice, coupled with the methodological lens of urban political ecology (UPE), this article unveils aspects that were either streamlined or obfuscated by the MGBs concerning climate injustice and colonial legacies in Mexico City’s hydrosocial cycle.

This article argues that MGBs’ financing of water infrastructure in Mexico City intertwines “green” debt with an unjust hydrosocial cycle. This interconnection obscures ongoing climate injustice and coloniality through climate action narratives that label the financing of water infrastructure projects as “green” interventions. In this context, this article engages with Sultana’s (2022b) concept of climate coloniality, advocating for the decolonization of climate action, which involves questioning the dynamics and narratives of “green” capitalism. According to Sultana, “green” capitalism contributes to the “reproduction of ongoing colonialities through existing global governance structures, discursive framings, imagined solutions and interventions” (2022b, p. 1). This article aims to illustrate that MGBs encapsulate and perpetuate these dynamics.

Methodologically, the article is based on participatory observation and 12 semi-structured interviews conducted over two months of fieldwork in Mexico City between February and March 2022. Meetings with water activists, household managers, and experts in public policy and climate finance informed the analysis of the distributive and narrative implications of the entangled water and capital circulation cycles promoted by MGBs and water infrastructure projects in Mexico City. [5] Equally crucial for this research was examining relevant financial documents (see Annex 5), press coverage, social media content, and public presentations delivered by key stakeholders involved in the MGB issuance.

The article’s structure unfolds as follows: Section 2 introduces the conceptual framework based on the notions of climate coloniality, climate justice, UPE, and the hydrosocial cycle. Section 3 presents an empirical analysis of the unjust hydrosocial cycle that cuts across Mexico City’s socio-economic fabric, highlighting its connection with the “green” debt finance promoted by the MGBs. Section 4 shows how the adoption of international “green” standards by the MGBs perpetuates the epistemic dominance of the global North with regard to “green” labeling. By ignoring local conditions, these international standards are instrumental in masking historical socio-economic and gender exclusions in the hydrosocial cycle of Mexico City. Section 5 scrutinizes the climate action narrative enabled by the MGBs, which allowed Mexico City’s government to create a positive public image despite financing non-substantial and non-additional projects. Finally, the conclusion synthesizes the central results and promotes further activist, academic, and policy engagements.

2. Climate coloniality, climate justice, and urban political ecology

This article uses the literature on the UPE of water (e.g., Colven, 2023; Linton & Budds, 2014; Swyngedouw, 2009) as a specific methodological lens to analyze the entangled circulatory cycles of “green” debt/capital and water. Through this lens, this study aims to uncover how these cycles co-produce environmental and climate injustices within urban settlements (e.g., Castro, 2006; Harvey, 1996; Kaika, 2005; Moore, 2015; Swyngedouw, 2009). In particular, the adoption of the UPE perspective reveals how water and “green” municipal debt become entangled in Mexico City’s unjust hydrosocial cycle. As defined by Linton and Budds (2014), the hydrosocial cycle represents a socio-natural process in which water and society transform one another across space and time. This concept shows that water not only influences the organization of a society, including aspects of finance, space, gender, and time labor, but also that social organization influences the management of water. [6]

Therefore, UPE serves as an analytical framework to scrutinize the co-production of urban settlements through ecological and social processes, such as the production and financing of water infrastructure, which often benefits some groups more than others (Heynen, Kaika, & Swyngedouw, 2006). For example, Delgado-Ramos (2015) investigated the dynamics of space production in Mexico City’s water metabolism, delineating how it “defines the socio-political and biophysical conditions suitable for capital accumulation and thus uneven development” (2015, p. 103). MGBs have also been explored in the UPE literature, in cases such as Washington DC (Christophers, 2018) and Cape Town and New York (Bigger & Millington, 2020, 2023), with a focus on environmental and financial risks.

Moreover, the UPE literature has engaged in a fruitful dialogue with the political economy literature on “green” bonds, analyzing the instrument’s political aspects (e.g., Bracking, 2015; Ferrando, De Oliveira Junqueira, Vecchione-Gonçalves, Miola, Marques Prol, & Herrera, 2021; García-Lamarca & Ullström, 2020; Jones, Baker, Huet, Murphy, & Lewis, 2020; Neumann, 2023). In the latter stream of literature, Hilbrandt and Grubauer (2020) scrutinized Mexico City’s MGBs, focusing on the role of “green” standards in this type of financial mechanism. Their analysis revealed that these standards had minimal impact on project implementation but played a crucial role in fostering knowledge and political support of “green” bonds, despite challenges in maintaining long-term support. Ultimately, this article contributes to the ongoing dialogue between these two bodies of literature by presenting a case study of Mexico City’s MGBs through a novel focus on water infrastructure and urban hydrosocial cycles.

In addition to the UPE and political economy literatures, this article provides insight into the concepts of climate coloniality and climate justice. Sultana defines climate coloniality as a system that “reproduces the hauntings of colonialism and imperialism through climate impacts in the post-colony” (2022b, p. 1). Climate coloniality[7] replicates the colonial matrix[8] of power and hierarchy in the climate governance regime, spanning institutional, financial, geopolitical, and epistemological dimensions (Sultana, 2022b). Therefore, this concept is instrumental in deciphering the colonial legacies, hierarchies, and power relations that become manifest in MGBs and the hydrosocial cycle of Mexico City. [9]

For example, MGBs have the potential to reproduce dynamics akin to international debt between lenders (usually from the Global North) and borrowers (usually from the Global South), which implies a relationship of power in the shaping of urban spaces. Climate finance instruments, such as grants, concessional loans, and non-concessional loans or debts, operate distinctively in terms of capital redistribution (Intergovernmental Panel on Climate Change [IPCC], 2023b). For instance, grants usually involve unidirectional capital flows from donor to beneficiary countries. In contrast, non-concessional loans, such as MGBs, involve bidirectional capital flows between lenders (financial investors) and borrowers (cities or municipalities), with borrowers bearing the obligation to repay loans, including interest, over time. Climate coloniality considers the effects of this power-driven financial relationship—disguised as “green” climate action—on local populations, raising questions of environmental and climate justice.

Climate justice is a concept with many [10] definitions and interpretations rooted in the expansive and diverse traditions of social movements and related academic literature, ranging from racial justice to social and environmental justice (e.g., Bullard, 2000; Bullard & Wright, 2019; Schlosberg & Collins, 2014). The Sixth Assessment Report of the IPCC [11] highlights three fundamental pillars of climate justice: the recognition of relevant actors and factors; the procedural aspects governing decision-making; and the just distribution of impacts and benefits over time and space (IPCC, 2023). While climate coloniality offers a more profound, historically informed, and radical [12] analytical framework, these three pillars of climate justice serve as valuable analytical tools for examining the effects of climate finance. Therefore, this article regards climate justice and climate coloniality as complementary concepts, enabling nuanced and overlapping analyses of the injustices and colonial legacies embedded within the circulatory cycles of water and “green” debt/capital in Mexico City.

Through these approaches, the following sections dissect the entangled materiality of the unjust hydrosocial cycle of water in Mexico City on the one hand and the “green” finance cycle of the MGBs on the other.

3. Embedding municipal ‘green’ bonds in Mexico City’s unjust hydrosocial cycle

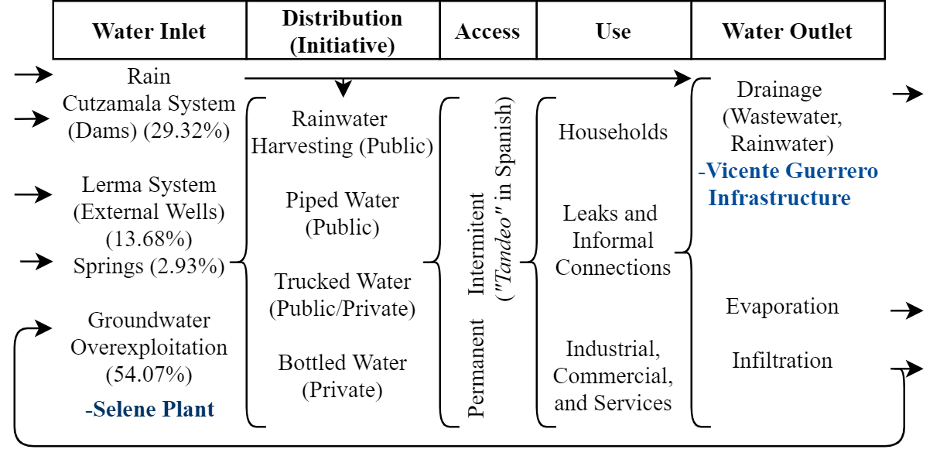

The hydrosocial cycle in Mexico City commences with the intake of water from various sources. About 29.32% of this water is sourced from the Cutzamala dam system, which channels water from western dams. Another 13.68% is derived from the Lerma system, which provides water from wells outside the city. Notably, 54.07% of the water comes from overexploited groundwaters within the city (SACMEX, as cited in Caracheo Miguel, 2021). After intake, water is distributed through various channels, encompassing pipes, trucks, bottles, and, to a lesser extent, harvested rainwater, facilitated by public and private initiatives. Finally, the water is discharged through the drainage system, along with evaporation and infiltration (see Figure 1 below).

Figure 1. Mexico City’s hydrosocial cycle and the water infrastructure linked to the MGBs. Source: Author.

The hydrosocial cycle in Mexico City is marked by three structural problems relevant to this analysis: intermittent access to water (scarcity), floods (excess), and gradual surface collapse due to groundwater overexploitation. These issues are rooted in the spatial and water configuration of Mexico City, shaped by colonial legacies and colonial times when the Spanish began draining the lake areas where today’s neighborhoods are located (Candiani, 2014; Vitz, 2018). These structural problems are further exacerbated by the climate crisis, intensifying water scarcity in dry seasons and excess water in rainy seasons.

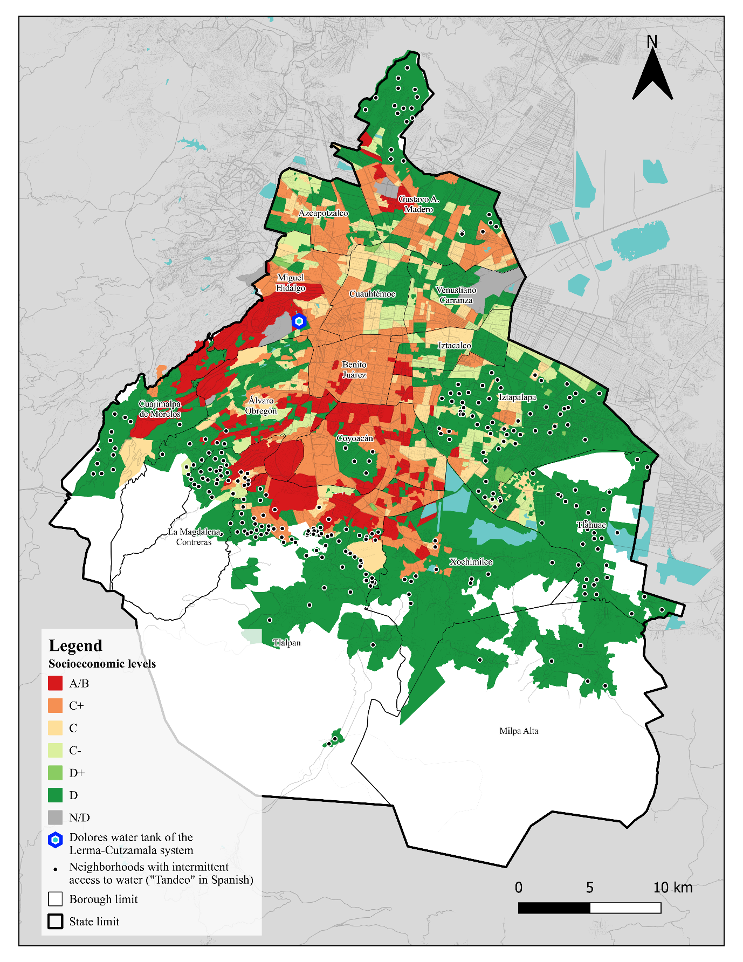

The structural problems of Mexico City’s hydrosocial cycle affect how water, space, and time are distributed among the city’s population. In Mexico City, the distribution of water and its associated benefits and challenges are intricately tied to the spatial positioning of households relative to water sources. Higher-income areas in the city’s center-west, such as Benito Juarez and Miguel Hidalgo, situated closer to the Lerma and Cutzamala systems, enjoy consistent access to water. In contrast, lower-income neighborhoods on the periphery, including those in Iztapalapa and Tláhuac, grapple with intermittent and insufficient access, as illustrated in Map 1 below. This disparity leads to the top income quintile utilizing over 42% of subsidized piped water, six times more than the lowest quintile, which relies on approximately 7% of the subsidized piped water (Morales-Novelo, Rodríguez-Tapia, & Revollo-Fernández, 2018). Consequently, inhabitants of lower-income neighborhoods must allocate additional financial resources to secure water from alternative sources, such as trucked and bottled water, as piped water is available only intermittently (Wunderlich, St. George Freeman, Galindo, Brown, & Kumpel, 2021). Simultaneously, the lower-income areas of Iztapalapa and Tláhuac face heightened risks of large floods (Mac Gregor-Gaona, Anglés-Hernández, Guibrunet, & Zambrano-González, 2021) and surface collapse due to groundwater overexploitation (Cigna & Tapete, 2021; Sosa-Rodríguez).

Map 1. Distribution of neighborhoods in Mexico City according to socio-economic levels and intermittent access to water (“tandeo” in Spanish). Concept: Author. Mapping: Diana Carolina Salazar Galindo.

The issuance of Mexico City’s MGBs to finance water infrastructure projects could initially be perceived as an effort to address the structural problems of the city’s hydrosocial cycle and thus improve the distribution of water. In December 2016, the Mexico City government marked a milestone in climate finance by issuing the first MGB in Latin America on the Mexican Stock Exchange Market for one billion Mexican pesos (US$57 million). The “green” debt funds were allocated to projects for water infrastructure (36%), sustainable transportation (58%), and energy efficiency (6%) (Carbon Trust, 2017). In 2018, Mexico City issued the second MGB for a value of 1.1 billion Mexican pesos (US$62.7 million), utilizing the funds to refinance and fund new water infrastructure projects (Carbon Trust, 2018a). Consequently, the MGBs issued in 2016 and 2018 facilitated the flow of “green” debt capital toward a sector affected by structural problems and characterized by an unjust distribution of water.

The biggest allocation of funds in water infrastructure from the first MGB was for the construction of the pumping plant and regulation lagoon at the Vicente Guerrero housing unit in the Santa Cruz Meyehualco sports field in the borough of Iztapalapa in eastern Mexico City (hereafter the Vicente Guerrero infrastructure), with an executed amount of US$7.8 million (Carbon Trust, 2018b). The second biggest allocation of funds in water infrastructure, with an executed figure of US$5.2 million, was in the Selene water treatment plant (Selene plant), which treats groundwater for distribution in neighborhoods in the borough of Tláhuac, also in eastern Mexico City (Carbon Trust, 2018b). This eastern region of the city is the epicenter of the impacts of unjust water distribution, as emphasized by a household head interviewed: “Iztapalapa has always been characterized by the fight for water, here there is no fight for land, let’s say for these material things, here the fight is for water” (Interview Feb 22, 2022).

The Vicente Guerrero infrastructure and the Selene plant financed through MGBs may initially seem to contribute positively to climate adaptation and climate justice. However, this article contends that such perceptions are misleading. On the one hand, the issuance of MGBs tied the city’s hydrosocial cycle to an unequal relationship of debt between the financial market and Mexico City’s government. This relationship of debt was traversed by specific amounts of “green” sums collected through the bond issuance, an interest rate determining investors’ profits, and the financing of water infrastructure projects. On the other hand, the financed water infrastructure projects constituted insubstantial responses that merely deferred substantial solutions, thereby perpetuating a state of climate injustice in the distribution of water in Mexico City, as explained below.

In Iztapalapa, in the outlet segment of the hydrosocial cycle, the Vicente Guerrero infrastructure regulates excessive rainwater by storing it in artificial lagoons and alleviating flooding during the rainy season. However, it fails to address the underlying issue of the location of low-income households in areas at high risk of flooding in the eastern part of the city. In Tláhuac, in the inlet segment of the cycle, the Selene plant represents an insubstantial short-term solution that perpetuates and reinforces the overexploitation of groundwater by filtering it for consumption, contributing to surface collapse. Consequently, the two projects financed by the MGBs did not effectively address the fundamental challenge of fairly redistributing water and space in Mexico City to reduce the risk of flooding, ensure sufficient access to water, and prevent surface collapsing irrespective of household income level (see Map 1). The hydrosocial cycle in Mexico City is a case in point of climate injustice that remains unaddressed by the MGB investments in water infrastructure.

Time poverty of women in Mexico City’s hydrosocial cycle

The entanglement of the financial and water cycles in Mexico City is revealed not only by the uneven distribution of water by neighborhood but also by the appropriation and non-recognition of additional water-related work of women. This is time poverty, where women’s unpaid high workload in terms of hours per day takes away time for paid work, formal education, personal care, and rest (UN Women, 2020). This often leaves women with little or no time to spare, affects their economic opportunities and health, and reproduces gender inequality (Hyde, Greene, & Darmstadt, 2020). Despite its significance, this issue remains widely neglected in the field of social policy in Latin America and requires further attention (Gammage, 2010). In the context of climate coloniality, persistent gendered exploitation manifests in various forms, including a “lack of access to clean water and sanitation, the racialized classed bodies laboring the land or waiting for water, (…) complex forms of abjection, precarity, uncertainty, exhaustion, trauma, stress among those deemed disposable” (Sultana, 2022b, p. 5).

The unjust distribution of water in Mexico City forces women in neighborhoods with intermittent access to water to spend a significant part of their day managing water (Montero, 2020). In the borough of Iztapalapa in eastern Mexico City, with a high number of neighborhoods with intermittent water access (see Map 1), it is usually women who assume the additional time to carry, store, filter, and recycle water, time that is sacrificed from other activities. Elaborating on this, a water activist emphasized: “Then, women begin to dedicate more time, more money to get the water truck, it is time dedicated only to bring water home when that time could be used by women to generate another source of income, to study” (Interview March 3, 2022).

In Iztapalapa, tap water is intermittent, and truck water is irregular. Women commonly spend several hours per day waiting for the tap water to function or locating a water truck to fill the household water tanks (tinacos in Spanish), which are ubiquitous in the borough’s cityscape (see Annex 3). When the water does reach the tap, it often comes with weak pressure, and then women “must be patient to fill their tanks” (Montero, 2020, p. 317). Too often, the quality of the water is subpar, and additional work is required to filter or boil it. Women’s labor to collect and manage water is not recognized as an economic activity by the government or counted as such, nor is it classified as an unjust burden for women; however, it is essential for the continuity of the hydrosocial cycle and for the entire Mexico City economy.

The unjust distribution of water in Mexico City translates into the appropriation and non-recognition of women’s labor related to water. As will be discussed in the next sections, the MGBs failed to recognize this gendered situation in the assignment of the “green” label and the associated climate action narrative that followed. Moreover, the gender dimension remained unaccounted for in the monitoring and evaluation of the projects financed by the MGBs.

An in-depth analysis of the interrelations between the MGBs and their financing of two water infrastructure projects—namely, the Selene plant and the Vicente Guerrero infrastructure—reveals two critical findings. First, both projects represent insubstantial responses to the structural problems of Mexico City’s hydrosocial cycle, including flooding, surface collapse due to groundwater overexploitation, intermittent access to water, and the associated time poverty experienced by women. Second, this finding contradicts the “green” labeling and the narrative of climate action promoted by the MGBs, as explained in the subsequent two sections.

4. Labeling “green” climate injustice and climate coloniality

According to the Green Bond Principles (GBPs), bonds labeled “green” are financial instruments wherein the mobilized resources are exclusively allocated to finance or refinance new or existing eligible projects classified as “green” (International Capital Market Association [ICMA], 2016). These projects must align with the four fundamental components of the GBPs: use of funds in projects with clear, ideally quantifiable environmental benefits; a transparent process for selecting eligible projects, ideally reviewed by an independent external reviewer; transparent management of financial resources; and, finally, a report that includes the list of financed projects, the amounts allocated, and their expected impact (ICMA, 2016). In short, GBPs serve as voluntary guidelines advocating transparency and integrity in the “green” bond market (ICMA, 2016).

This section argues that the “green” labeling process of Mexico City’s MGBs ignored the local context of climate injustice and climate coloniality and served as a performative tool to fuel a narrative of climate action.

Sustainalytics evaluated whether the “green” bond proposal aligned with the four pillars of the GBPs, maintained solid and transparent criteria for project selection and financial management, and included key performance indicators (KPIs) of results, including those related to water (Sustainalytics, 2016). This process corresponds to the provision of a “second opinion” in the reference framework of the 2016 MGB of Mexico City. Sustainalytics concluded that “the Mexico City green bond is solid, credible, and transparent” (2016, p. 10), with a disclaimer clarifying that its opinion is for informational purposes only and that the responsibility for implementation and monitoring lies with the client—in this case, Mexico City. Complications arose due to the lack of a Mexican branch of Sustainalytics, which is a foreign verifier based in New York, necessitating special permissions, foreign currency payments, and documentation translation (Hilbrandt & Grubbauer, 2020). Subsequently, the Global North consultancy Carbon Trust, with a branch in Mexico City, took over the verification process and provided a follow-up report.

Carbon Trust analyzed public and official information and concluded that “the resources of the 2016 Green Bond are traceable and were intended to finance projects with an environmental and climate impact” (Carbon Trust, 2017, p. 5). The annual quantitative indicators chosen for evaluating the impact of water and wastewater management projects included the number of people who benefited and the volume of water (m3) (Carbon Trust, 2017). Specifically, for the two projects of interest in this article, the report concluded that the Vicente Guerrero infrastructure has an artificial regulation lagoon with the capacity to store 90,000 m3 of rainwater and wastewater, benefiting 145,000 people in Iztapalapa. The Selene plant had an installed water filtration capacity of 120 l/s, producing a drinking water volume of 10,368 m3/day and benefiting 41,472 people primarily located in Tláhuac (Carbon Trust, 2017).

In the Carbon Trust report, the positive environmental impact of these two water infrastructure projects is reduced to two quantitative variables: the volume of water and the number of people in the vicinity. Nevertheless, the report briefly mentioned that the water infrastructure projects were implemented in neighborhoods “with a high vulnerability index, and where water resources are precarious and deficient, which is why it is necessary to rehabilitate or replace the drainage systems, drinking water pipes and plants” (Carbon Trust, 2017, p. 27). Finally, the follow-up report stated that the resources of the “green” bond are traceable and were allocated to projects with environmental and climate impacts (Carbon Trust, 2017). For the MGB released in 2018, Carbon Trust offered both the second opinion and the follow-up report, with no relevant changes to this analysis (see Annex 5 for a detailed list of financial documents).

As evidenced by the second opinions and follow-up reports of Sustainalytics and Carbon Trust, the “green” labeling process of Mexico City’s MGBs focused on quantitative indicators, overlooking the socio-economic and gender dimensions that characterized the city’s hydrosocial cycle. In general, the time poverty experienced by women was ignored and unaccounted for in the monitoring and evaluation indicators. Specifically, for the Selene plant and the Vicente Guerrero infrastructure projects, the structural problems related to the inequitable distribution of water and space in Mexico City and the potential perpetuation of these issues were not adequately considered. Moreover, the “green” label attached to the MGBs was predominantly formulated in the Global North, albeit with the participation of local actors, including the Secretaries of Finance and Environment.

By labeling the MGBs and the financed water infrastructure projects as “green,” international standards contributed to obscuring the unjust aspects of the city’s hydrosocial cycle under the guise of environmental friendliness, serving as a performative tool for the climate action narrative that followed, as explained in the next section. This omission represents a significant failure to uphold the climate justice principle regarding the recognition of exclusionary factors when designing climate action interventions.

5. The narrative of climate (in)action

The actors involved in the MGBs framed this financial intervention as climate action and as evidence of Mexico City’s environmental commitment. However, the aforementioned omissions of climate injustice revealed that this portrayal primarily functioned as a narrative of climate (in)action. It generated positive publicity without securing new financial resources that were otherwise unavailable or initiating new projects that were not already scheduled to happen. In reality, the MGBs did not introduce any additional resources from debt instruments, as Mexico City already possessed favorable credit ratings and had prior experience issuing regular municipal bonds, as well as reaching agreements with commercial and development banks (Secretaría de Administración y Finanzas de la Ciudad de México, 2018).

In other words, the MGBs lacked additionality, incorporating initiatives that were already planned rather than catalyzing the implementation of new projects (C40, 2017). The broader critique of “green” bonds centers on their tendency to repackage regular projects without adding any new action or value (Jones, Baker, Huet, Murphy, & Lewis, 2020). Notably, the Vicente Guerrero infrastructure had been announced in January 2015, a year before the issuance of the first MGB (Obras, 2015). Furthermore, the analysis by Hilbrandt and Grubbauer (2020) on Mexico City’s MGBs highlights the limited impact of “green” standards on actual project execution while emphasizing their role in stimulating markets, knowledge, and support of “green” bonds. In essence, the MGBs did not alter or add to the implementation of projects but rather served as a promotional tool for market engagement.

Despite these shortcomings, the climate (in)action narrative was mobilized by the Mexico City government during and after the MGB issuance. In 2017, Mexico City, represented by Mayor Miguel Ángel Mancera, received the “bond of the year award in the municipal category” for its issuance of the 2016 MGB (Development Finance, 2017; Environmental Finance, 2017). This bond was the first of its kind in Latin America and therefore became a benchmark, often cited in documents related to MGBs (CBI, 2016). In Mayor Mancera’s own words, “Innovation to finance climate action is a commitment that Mexico City has assumed, and in December 2016, we became the first city in Latin America to issue a green bond” (C40, 2017, p. 6).

The Secretary of Finance at the time reflected on the local reception of the narrative: “The public impact that the green bond had on the Mexican press, on the Mexican media was astounding… We never had this kind of press with the regular bonds of Mexico City. It was like it was a celebrity. We were very surprised by the reception the green bond had on the press” (C40, 2017).

In 2018, the Secretary of Environment’s YouTube channel published a promotional video on MGBs, accumulating 267,360 views, with the following statement: “To promote environmentally friendly urban development projects, Mexico City requires a lot of money, which is why the green bond is a great ally… It was the first time that a local government in Latin America issued a green bond and it was possible thanks to the fact that the city has strong and healthy finances and has a portfolio of environmentally friendly projects” (SEDEMA, 2018). This narrative reiterates that the MGB issuance was made possible by the city’s preexisting financial capacity and established projects.

From the financial sector’s perspective, the Head of Debt Capital Markets at HSBC Mexico, the underwriter of the 2016 MGB, asserted, “The press coverage you received and all that political goodwill you received to keep doing good things and good environmental projects is priceless, I think, and it pays its investment many times over” (C40, 2017).

During the 2017 inauguration of the Vicente Guerrero infrastructure, the city mayor remarked, “There is a long way from saying to doing, but what we are showing you today is that the investment is here, in Iztapalapa” (Mancera, 2017). Mancera promoted this as a climate adaptation success story, emphasizing the increased capacity to regulate rainwater during annual flood periods. This inauguration also received coverage by the press (e.g., Rodríguez, 2017; Romero, 2017).

The narrative about “green” bonds underwent a shift under the following mayor of Mexico City, Claudia Sheinbaum, elected for the 2018–2024 term. Sheinbaum publicly expressed skepticism about the financial performance of MGBs, stating that “the green bond was lousy business for the city” (Milenio, 2019). In essence, the issuance of municipal bonds labeled “green” in Mexico City failed to enhance project execution, stimulate the construction of additional projects, and recognize climate justice considerations, including gender or socio-economic factors. Instead, the MGBs issuance contributed to obscuring climate injustice and coloniality within the city’s hydrosocial cycle through the application of the “green” label and the narrative of climate (in)action.

6. Conclusion

The use of municipal bonds with a “green” label, while intended to foster climate action, has paradoxically reinforced narratives, knowledge forms, and distribution patterns that perpetuate climate injustice and colonial legacies. Adopting the analytical lenses of climate coloniality and climate justice and the methodology of UPE, it was found that the issuance of the two MGBs in Mexico City and the progression of the global discursive framing of “green” finance further entangled the city’s water and financial circulations while masking colonial legacies, such as gender and socio-economic inequalities. Importantly, the “greening” of the bonds served more as a performative gesture for local and international audiences rather than an earnest effort of climate adaptation and climate justice, given the lack of substantive actions and the omission of climate justice aspects in its formulation, implementation, and evaluation. Furthermore, this study highlights the dominance of Global North perspectives in defining and enforcing “green” standards while overlooking and masking climate injustices and colonial legacies in the local context.

Further inquiry is crucial to comprehending the materialization and perpetuation of climate coloniality and climate injustice in the execution of climate finance instruments, particularly “green” bonds. Moreover, the political ecology debate about “green” bonds necessitates more exploration, given the rapid global proliferation of this debt instrument and its intricate involvement in financial and environmental distributions, as exemplified by the water distribution issues in this study. The field of political ecology can provide valuable insights and contributions to this emerging debate. It is recommended that both researchers and policy-makers conduct additional qualitative, quantitative, and mixed-methods studies adopting a climate justice approach to deepen the understanding of these complex dynamics.

Finally, an analytical approach grounded in justice perspectives has proven to be pertinent to the municipal bond experience in the US, where this market has a long-established presence. For instance, in 2021, the Committee on Financial Services of the US House of Representatives convened a session to scrutinize the impact of municipal bonds in racial justice (US House Committee on Financial Services, 2021). Furthermore, in 2023, a voluntary framework for Municipal Bond Markets and Racial Equity was introduced, delineating essential inquiries to guide issuers in evaluating their practices. This framework includes considerations such as the impact on water access for low-income residents or historically marginalized groups (Public Finance Initiative, 2023). In addition to the insights provided by this article, the municipal bond experience in the US reiterates that a justice perspective is crucial for formulating, implementing, and evaluating municipal bonds with a “green” label. Importantly, initiatives are already underway in this regard.

Acknowledgments

The author expresses gratitude to the valuable feedback from two anonymous reviewers, the editors, particularly Diego Silva Garzón, and Professors Tomaso Ferrando and Hanna Hilbrandt. Additionally, this article benefited from discussions at the conference “Climate Coloniality: Mechanisms, Epistemologies, Spaces of Resistance” held virtually on November 22–24, 2022. Special thanks go to Jeanine Legato for editorial support and Diana Carolina Salazar Galindo for cartographic assistance.

Notes

[1] PhD researcher at the University of Antwerp’s Institute of Development Policy (IOB). Email: hector.herrera@uantwerpen.be; ORCID: 0000-0003-0696-4890.

[2] To indicate that the word “green” is a label rather than an adjective, it is used in quotation marks throughout the article.

[3] Raising US$303.8 billion between 2001 and 2018 (United Nations Climate Change, 2018).

[4] Raising US$10.3 billion between its inception in 2010 and July 31, 2020 (Green Climate Fund, n.d.).

[5] The interviewees were selected based on their knowledge of the hydrosocial cycle or the climate finance cycle in Mexico City. The interviews were conducted in Spanish, audio recorded, and transcribed for analysis. All sources were treated with confidentiality and kept anonymous. The interviews were carried out following the guidance of the Ethics Committee for the Social Sciences and Humanities of the University of Antwerp. List of interviews with dates: 4 water activists (February 3, 2022; March 2, 2022; March 3, 2022; March 11, 2022), 4 household heads (February 22, 2022; February 24, 2022; March 13, 2022; March 14, 2022), 2 policy experts (March 4, 2022; July 3, 2022), and 2 academics (February 24, 2022; March 5, 2022).

[6] For more about the hydrosocial cycle, see Boelens, Hoogesteger, Swyngedouw, Vos & Wester (2016); Linton and Budds (2014); McCulligh, Arellano-García, and Casas-Beltrán (2020); and Swyngedouw (2009).

[7] See Quijano (2007).

[8] See Mignolo and Walsh (2018).

[9] For an internal colonialism approach in Mexico City, see De Coss-Corzo (2023).

[10] See, for example, Álvarez and Coolsaet (2020); Amorim-Maia, Anguelovski, Chu, and Connolly, (2022); Bulkeley, Carmin, Castán Broto, Edwards, and Fuller (2013); Gonzalez (2020); Sultana (2022a); Wilkens and Datchoua-Tirvaudey (2022).

[11] There are many definitions of climate justice, but in this article, the IPCC definition is preferred because of the role of this institution in the climate governance regime, guiding and evaluating climate policy (Beck & Mahony, 2018).

[12] Also in the sense of getting at or addressing “the root” cause.

References

Álvarez, L., & Coolsaet, B. (2020). Decolonizing environmental justice studies: A Latin American perspective. Capitalism Nature Socialism, 31(2), 50–69. https://doi.org/10.1080/10455752.2018.1558272

AMAI. (n.d.). Niveles socio económicos [Socioeconomic levels]. Retrieved from https://www.amai.org/NSE/index.php?queVeo=preguntas

Amorim-Maia, A. T., Anguelovski, I., Chu, E., & Connolly, J. (2022). Intersectional climate justice: A conceptual pathway for bridging adaptation planning, transformative action, and social equity. Urban Climate, 41, 101053. https://doi.org/10.1016/j.uclim.2021.101053

Beck, S., & Mahony, M. (2018). The IPCC and the new map of science and politics. WIREs Climate Change, 9(6), e547. https://doi.org/10.1002/wcc.547

Bigger, P., & Millington, N. (2020). Getting soaked? Climate crisis, adaptation finance, and racialized austerity. Environment and Planning E: Nature and Space, 3(3), 601–623. https://doi.org/10.1177/2514848619876539

Bigger, P., & Millington, N. (2023). Temporalities of the climate crisis: Maintenance, green finance and racialized austerity in New York City and Cape Town. In A. Wiig, K. Ward, T. Enright, M. Hodson, H. Pearsall, & J. Silver (Eds.), Infrastructuring urban futures (pp. 42–66). Bristol University Press. https://doi.org/10.51952/9781529225648.ch003

BloombergNEF. (2020). Record month shoots green bonds past trillion-dollar mark. BloombergNEF. Retrieved from https://about.bnef.com/blog/record-month-shoots-green-bonds-past-trillion-dollar-mark/

Boelens, R., Hoogesteger, J., Swyngedouw, E., Vos, J., & Wester, P. (2016). Hydrosocial territories: A political ecology perspective. Water International, 41(1), 1–14. https://doi.org/10.1080/02508060.2016.1134898

Bracking, S. (2015). Performativity in the green economy: How far does climate finance create a fictive economy? Third World Quarterly, 36(12), 2337–2357. https://doi.org/10.1080/01436597.2015.1086263

Bracking, S. (2019). Financialisation, climate finance, and the calculative challenges of managing environmental change. Antipode, 51(3), 709–729. https://doi.org/10.1111/anti.12510

Bracking, S., & Leffel, B. (2021). Climate finance governance: Fit for purpose? WIREs Climate Change, 12(4). https://doi.org/10.1002/wcc.709

Bulkeley, H., Carmin, J., Castán Broto, V., Edwards, G. A. S., & Fuller, S. (2013). Climate justice and global cities: Mapping the emerging discourses. Global Environmental Change, 23(5), 914–925. https://doi.org/10.1016/j.gloenvcha.2013.05.010

Bullard, R. D. (2000). Dumping in Dixie: Race, class, and environmental quality (3rd ed.). Westview Press.

Bullard, R., & Wright, B. (Eds.). (2019). Race, place, and environmental justice after Hurricane Katrina: Struggles to reclaim, rebuild, and revitalize New Orleans and the Gulf Coast (1st ed.). Routledge. https://doi.org/10.4324/9780429497858

C40. (2017). Mexico City Mayor Miguel Angel Mancera on innovative climate action finance and the first green bond issued by a Latin American city. C40 Cities. Retrieved from https://www.c40.org/news/mexico-city-mayor-miguel-angel-mancera-on-innovative-climate-action-finance-and-the-first-green-bond-issued-by-a-latin-american-city/

Candiani, V. S. (2014). Dreaming of dry land: Environmental transformation in colonial Mexico City. Stanford University Press.

Caracheo Miguel, C. E. (2021). Desigualdad territorial y acceso a agua potable en el contexto de pandemia en la Ciudad de México [Territorial inequality and access to drinking water in the context of the pandemic in Mexico City]. Argumentos: Revista de Crítica Social. Retrieved from https://publicaciones.sociales.uba.ar/index.php/argumentos/article/view/6976

Carbon Trust. (2017). Seguimiento y evaluación de la emisión del bono verde 2016 de la CDMX [Monitoring and evaluation of the issuance of the 2016 Mexico City green bond]. Retrieved from http://www.data.sedema.cdmx.gob.mx/cambioclimaticocdmx/images/biblioteca_cc/Primer-reporte-Seguimiento-Bono-Verde-2016.pdf

Carbon Trust. (2018a). Evaluación del Bono Verde de la Ciudad de México 2018 Segunda Opinión [Evaluation of the Green Bond of Mexico City 2018 Second Opinion]. Retrieved from http://procesos.finanzas.cdmx.gob.mx/bono_verde/docs/documentos/Segunda_opinion_BV_2018_CDMX_Carbon_Trust.pdf

Carbon Trust. (2018b). Seguimiento y Evaluación de la Emisión del Bono Verde 2016 de la CDMX [Monitoring and Evaluation of the Issuance of the 2016 Green Bond of Mexico City]. Retrieved from http://www.data.sedema.cdmx.gob.mx/cambioclimaticocdmx/images/biblioteca_cc/Primer-reporte-Seguimiento-Bono-Verde-2016.pdf

Castro, J. E. (2006). Water, power and citizenship. Palgrave Macmillan UK. https://doi.org/10.1057/9780230508811

Christophers, B. (2018). Risk capital: Urban political ecology and entanglements of financial and environmental risk in Washington, D.C. Environment and Planning E: Nature and Space, 1(1–2), 144–164. https://doi.org/10.1177/2514848618770369

Cigna, F., & Tapete, D. (2021). Present-day land subsidence rates, surface faulting hazard and risk in Mexico City with 2014–2020 Sentinel-1 IW InSAR. Remote Sensing of Environment, 253, 112161. https://doi.org/10.1016/j.rse.2020.112161

Climate Bonds Initiative [CBI]. (2016). Mexico City issues 1st muni bond from Latin America! MXN 1 bn (USD 50m), 4th from Mexico! Climate Bonds Initiative. Retrieved from https://www.climatebonds.net/2016/12/mexico-city-issues-1st-muni-bond-latin-america-mxn-1-bn-usd-50m-4th-mexico

Climate Bonds Initiative. (2020). América Latina y el Caribe Estado del mercado de las finanzas verdes 2019 [Latin America and the Caribbean State of the green finance market 2019]. Climate Bonds Initiative. Retrieved from https://www.climatebonds.net/files/reports/latam_sotm_19_esp_final_03_web_0.pdf

Climate Policy Initiative. (2023). Financial aggregation blueprints for urban climate infrastructure. Retrieved from https://www.climatepolicyinitiative.org/wp-content/uploads/2023/06/Financial-Aggregation-Blueprints-for-Urban-Climate-Infrastructure.pdf

Colven, E. (2023). A political ecology of speculative urbanism: The role of financial and environmental speculation in Jakarta’s water crisis. Environment and Planning A: Economy and Space, 55(2), 490–510. https://doi.org/10.1177/0308518X221110883

Córdoba Capital. (2022). Córdoba es la primera ciudad en emitir un Bono Verde en Argentina [Córdoba is the first city to issue a Green Bond in Argentina]. Retrieved from https://cordoba.gob.ar/cordoba-es-la-primera-ciudad-en-emitir-un-bono-verde-en-argentina/

Cortina de Cardenas, S. M. (2011). Does private management lead to improvement of water services? Lessons learned from the experiences of Bolivia and Puerto Rico (Doctoral dissertation, University of Iowa). https://doi.org/10.17077/etd.80v1sojx

De Coss‐Corzo, A. (2023). The infrastructures of internal colonialism: State, environment, and race in Lerma, Mexico. Antipode, 55(3), 810–829. https://doi.org/10.1111/anti.12918

Delgado-Ramos, G. (2015). Water and the political ecology of urban metabolism: The case of Mexico City. Journal of Political Ecology, 22(1). https://doi.org/10.2458/v22i1.21080

Development Finance. (2017). Mexico City wins green bond award. Development Finance. Retrieved from https://www.devfinance.net/mexico-city-wins-award-issuing-latin-americas-first-green-bond/

Economic Commission for Latin America and the Caribbean. (2017). The rise of green bonds. Financing for development in Latin America and the Caribbean. Retrieved from https://repositorio.cepal.org/bitstream/handle/11362/42230/1/S1700985_en.pdf

Environmental Finance. (2017). Bond of the year: Municipal—Mexico City. Retrieved from https://www.environmental-finance.com/content/awards/green-bond-awards-2017/winners/bond-of-the-year-municipal-mexico-city.html

Ferrando, T., De Oliveira Junqueira, G., Vecchione-Gonçalves, M., Miola, I., Marques Prol, F., & Herrera, H. (2021). Capitalizing on green debt: A world-ecology analysis of green bonds in the Brazilian forestry sector. Journal of World-Systems Research, 27(2), 410–438. https://doi.org/10.5195/jwsr.2021.1062

Gammage, S. (2010). Time pressed and time poor: Unpaid household work in Guatemala. Feminist Economics, 16(3), 79–112. https://doi.org/10.1080/13545701.2010.498571

García-Lamarca, M., & Ullström, S. (2020). “Everyone wants this market to grow”: The affective post-politics of municipal green bonds. Environment and Planning E: Nature and Space, 251484862097370. https://doi.org/10.1177/2514848620973708

Gonzalez, C. (2020). Racial capitalism, climate justice, and climate displacement. Oñati Socio-Legal Series, 11(1), 108–147. https://doi.org/10.35295/OSLS.IISL/0000-0000-0000-1137

Green Climate Fund. (n.d.). Resource mobilisation. Retrieved from https://www.greenclimate.fund/about/resource-mobilisation/irm

Harvey, D. (1996). Justice, nature, and the geography of difference. Cambridge, England: Blackwell Publishers.

Hernández Estrada, L. L. (2018). Sistema Cutzamala manda 16 mil litros de agua por segundo a CDMX [Cutzamala system sends 16 thousand liters of water per second to Mexico City]. Noticieros Televisa. Retrieved from https://noticieros.televisa.com/ultimas-noticias/sistema-cutzamala-manda-16-mil-litros-de-agua-por-segundo-a-cdmx/

Heynen, N., Kaika, M., & Swyngedouw, E. (Eds.). (2006). In the nature of cities: Urban political ecology and the politics of urban metabolism. Oxford, England: Routledge.

Hilbrandt, H., & Grubbauer, M. (2020). Standards and SSOs in the contested widening and deepening of financial markets: The arrival of green municipal bonds in Mexico City. Environment and Planning A: Economy and Space, 52(7), 1415–1433. https://doi.org/10.1177/0308518X20909391

Howell-Moroney, M. E., & Hall, J. L. (2011). Waste in the sewer: The collapse of accountability and transparency in public finance in Jefferson County, Alabama. Public Administration Review, 71(2), 232–242. https://doi.org/10.1111/j.1540-6210.2011.02334.x

HR Ratings. (2018). Crecimiento del Mercado de Bonos Verdes, Sociales y Sustentables en México [Growth of the Green, Social and Sustainable Bond Market in Mexico]. Retrieved from https://www.hrratings.com/pdf/Sectorial%20Bonos%20Sustentables.pdf

Hyde, E., Greene, M. E., & Darmstadt, G. L. (2020). Time poverty: Obstacle to women’s human rights, health and sustainable development. Journal of Global Health, 10(2), 020313. https://doi.org/10.7189/jogh.10.020313

Intergovernmental Panel on Climate Change. (2023). Climate change 2022 – Impacts, adaptation and vulnerability: Working Group II contribution to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change (1st ed.). Cambridge University Press. https://doi.org/10.1017/9781009325844

International Capital Market Association [ICMA]. (2016). Green Bond Principles, 2016. Retrieved from https://www.icmagroup.org/assets/documents/Regulatory/Green-Bonds/GBP-2016-Final-16-June-2016.pdf

Jones, R., Baker, T., Huet, K., Murphy, L., & Lewis, N. (2020). Treating ecological deficit with debt: The practical and political concerns with green bonds. Geoforum, 114, 49–58. https://doi.org/10.1016/j.geoforum.2020.05.014

Kaika, M. (2005). City of flows: Modernity, nature, and the city. New York, USA: Routledge.

Linton, J., & Budds, J. (2014). The hydrosocial cycle: Defining and mobilizing a relational-dialectical approach to water. Geoforum, 57, 170–180. https://doi.org/10.1016/j.geoforum.2013.10.008

Mac Gregor-Gaona, M. F., Anglés-Hernández, M., Guibrunet, L., & Zambrano-González, L. (2021). Assessing climate change risk: An index proposal for Mexico City. International Journal of Disaster Risk Reduction, 65, 102549. https://doi.org/10.1016/j.ijdrr.2021.102549

Mancera, M. Á. (2017). Conoce el Proyecto Integral Vicente Guerrero Colector [Get to know the Vicente Guerrero Collector Comprehensive Project]. Retrieved from https://www.facebook.com/watch/?v=1382295548549248

McCulligh, C., Arellano-García, L., & Casas-Beltrán, D. (2020). Unsafe waters: The hydrosocial cycle of drinking water in Western Mexico. Local Environment, 25(8), 576–596. https://doi.org/10.1080/13549839.2020.1805598

Mejía-Escobar, J. C., González-Ruiz, J. D., & Franco-Sepúlveda, G. (2021). Current state and development of green bonds market in the Latin America and the Caribbean. Sustainability, 13(19), 10872. https://doi.org/10.3390/su131910872

Mignolo, W., & Walsh, C. E. (2018). On decoloniality: Concepts, analytics, praxis. Durham, USA: Duke University Press.

Milenio. (2019). Bonos Verdes, mal negocio para CdMx: Sheinbaum [Green Bonds, bad business for Mexico City: Sheinbaum]. Retrieved from https://www.milenio.com/videos/politica/bonos-verdes-mal-negocio-para-cdmx-sheinbaum

Montero, D. (2020). El abastecimiento de agua en Iztapalapa. Un análisis institucional [The water supply in Iztapalapa. An institutional analysis]. Revista de Economía Institucional. Retrieved from http://www.scielo.org.co/scielo.php?script=sci_arttext&pid=S0124-59962020000200301

Moore, J. W. (2015). Capitalism in the web of life: Ecology and the accumulation of capital (1st ed.). London, England: Verso.

Morales-Novelo, J., Rodríguez-Tapia, L., & Revollo-Fernández, D. (2018). Inequality in access to drinking water and subsidies between low and high income households in Mexico City. Water, 10(8), 1023. https://doi.org/10.3390/w10081023

Neumann, M. (2023). The political economy of green bonds in emerging markets: South Africa’s faltering transition. Switzerland: Springer Nature Switzerland. https://doi.org/10.1007/978-3-031-30502-3

Obras. (2015). El GDF invertirá 300 mdp para agua potable y drenaje en Iztapalapa [The GDF will invest 300 million pesos for drinking water and drainage in Iztapalapa]. Obras. Retrieved from https://obras.expansion.mx/construccion/2015/01/28/el-gdf-invertira-300-mdp-para-agua-potable-y-drenaje-en-iztapalapa

OECD. (2022). Green, social, sustainability and sustainability-linked bonds in developing countries: How can donors support public sector issuances? OECD Publishing. Retrieved from https://www.oecd.org/dac/green-social-sustainability-and-sustainability-linked-bonds.pdf

Phinney, S. (2023). The policing of Black debt: How the municipal bond market regulates the right to water. Urban Geography, 44(8), 1584–1607. https://doi.org/10.1080/02723638.2022.2107257

Ponder, C. S. (2023). “Cuando Colón baje el dedo”: The role of repair in urban reproduction. Urban Geography, 44(9), 1853–1873. https://doi.org/10.1080/02723638.2022.2093050

Ponder, C. S., & Omstedt, M. (2022). The violence of municipal debt: From interest rate swaps to racialized harm in the Detroit water crisis. Geoforum, 132, 271–280. https://doi.org/10.1016/j.geoforum.2019.07.009

Public Finance Initiative. (2023). Bond markets & racial equity issuer technical assistance. Public Finance Initiative. Retrieved from https://files.elfsightcdn.com/eafe4a4d-3436-495d-b748-5bdce62d911d/e90cc781-0051-4565-af0e-658aaf8fda29/3-26-23-Framework-8-.pdf

Quijano, A. (2007). Coloniality and modernity/rationality. Cultural Studies, 21(2–3), 168–178. https://doi.org/10.1080/09502380601164353

Rodríguez, D. (2017). Inauguraron infraestructura para evitar inundaciones [Inaguration of infrastructure to prevent flooding]. Retrieved from https://centrourbano.com/construccion/inauguraron-infraestructura-evitar-inundaciones/

Romero, G. (2017). Inaugura Mancera planta de bombeo; evitará inundaciones [Pumping plant inaugurated by Mancera; will prevent flooding.]. La Jornada. Retrieved from https://www.jornada.com.mx/2017/07/21/capital/028n1cap

Schlosberg, D., & Collins, L. B. (2014). From environmental to climate justice: Climate change and the discourse of environmental justice. WIREs Climate Change, 5(3), 359–374. https://doi.org/10.1002/wcc.275

Secretaría de Administración y Finanzas de la Ciudad de México. (2018). Situación de la deuda pública del Gobierno de la Ciudad de México, Cuarto informe trimestral [Public debt situation of the Government of Mexico City, Fourth quarterly report]. Retrieved from https://servidoresx3.finanzas.cdmx.gob.mx/documentos/Cuarto_Informe_Trimestral_de_la_Situacion_de_la_Deuda_de_la_CDMX.pdf

SEDEMA. (2018). Conoce el Bono Verde de la SEDEMA CDMX [Learn about the Green Bond of the Mexico City Environment Office]. Retrieved from https://www.youtube.com/watch?v=4KMIhGdwqcw

Sosa-Rodríguez, F. S. (2010). Impacts of water-management decisions on the survival of a city: From ancient Tenochtitlan to modern Mexico City. International Journal of Water Resources Development, 26(4), 675–687. https://doi.org/10.1080/07900627.2010.519503

Sultana, F. (2022a). Critical climate justice. The Geographical Journal, 188(1), 118–124. https://doi.org/10.1111/geoj.12417

Sultana, F. (2022b). The unbearable heaviness of climate coloniality. Political Geography, 99, 102638. https://doi.org/10.1016/j.polgeo.2022.102638

Sustainalytics. (2016). Marco de Referencia del Bono Verde de la Ciudad de México (CDMX). Segunda Opinión de Sustainalytics. [Reference Framework for the Green Bond of Mexico City (CDMX). Sustainalytics Second Opinion].

Sustainalytics. (2017). The province of Jujuy green bond [The province of Jujuy green bond]. Retrieved from https://mstar-sustops-cdn-mainwebsite-s3.s3.amazonaws.com/docs/default-source/spos/province-of-jujuy-green-bond-framework-and-opinion-07132017-final.pdf?sfvrsn=6dfb988c_3

Swyngedouw, E. (2009). The political economy and political ecology of the hydro-social cycle. Journal of Contemporary Water Research & Education, 142(1), 56–60. https://doi.org/10.1111/j.1936-704X.2009.00054.x

United Nations Climate Change. (2018). Achievements of the clean development mechanism 2001–2018. Retrieved from https://unfccc.int/sites/default/files/resource/UNFCCC_CDM_report_2018.pdf

United Nations Climate Change. (n.d.). Introduction to Climate Finance. Retrieved from https://unfccc.int/topics/climate-finance/the-big-picture/introduction-to-climate-finance

UN Women. (Ed.). (2020). Why addressing women’s income and time poverty matters for sustainable development. United Nations. Retrieved from https://www.unwomen.org/sites/default/files/Headquarters/Attachments/Sections/Library/Publications/2019/World-survey-on-the-role-of-women-in-development-2019.pdf

US House Committee on Financial Services. (2021). Examining the role of municipal bond markets in advancing – and undermining – economic, racial and social justice. Retrieved from https://www.congress.gov/event/117th-congress/house-event/LC66789/text?s=1&r=64

Villanueva, J., Cobián, M., & Rodríguez, F. (2018). San Juan, the fragile city: Finance capital, class, and the making of Puerto Rico’s economic crisis. Antipode, 50(5), 1415–1437. https://doi.org/10.1111/anti.12406

Vitz, M. (2018). A city on a lake: Urban political ecology and the growth of Mexico City. Durham, USA: Duke University Press.

Wilkens, J., & Datchoua-Tirvaudey, A. R. C. (2022). Researching climate justice: A decolonial approach to global climate governance. International Affairs, 98(1), 125–143. https://doi.org/10.1093/ia/iiab209

Wunderlich, S., St. George Freeman, S., Galindo, L., Brown, C., & Kumpel, E. (2021). Optimizing household water decisions for managing intermittent water supply in Mexico City. Environmental Science & Technology, 55(12), 8371–8381. https://doi.org/10.1021/acs.est.0c08390

List of consulted financial documents

Sustainalytics. Reference framework of the Mexico City green bond. Sustainalytics second opinion. (In Spanish, “Marco de Referencia del Bono Verde de la Ciudad de México (CMDX). Segunda Opinión de Sustainalytics”). November 11, 2016. Available at (accessed Sep 5, 2023) http://www.data.sedema.cdmx.gob.mx/cambioclimaticocdmx/images/biblioteca_cc/Reporte-Segunda-Opinion-Bono-Verde-2016.pdf

Carbon Trust. Monitoring and evaluation of the issuance of the 2016 green bond of Mexico City. First follow-up report. (In Spanish, “Seguimiento y Evaluación de la Emisión del Bono Verde 2016 de la CDMX. Primer Reporte de Seguimiento”). 2017. Available at (accessed Sep 5, 2023) http://www.data.sedema.cdmx.gob.mx/cambioclimaticocdmx/images/biblioteca_cc/Primer-reporte-Seguimiento-Bono-Verde-2016.pdf

Carbon Trust. Monitoring and evaluation of the 2016 green bond issuance of Mexico City – Second monitoring report (In Spanish, “Seguimiento y Evaluación de la Emisión del Bono Verde 2016 de la CDMX - Segundo Reporte de Seguimiento”). November 20, 2018. Available at (accessed Sep 5, 2023) http://www.data.sedema.cdmx.gob.mx/cambioclimaticocdmx/images/biblioteca_cc/Segundo_reporte_de_seguimiento_Bono_Verde_2016.pdf

Carbon Trust. Evaluation of the 2018 green bond of Mexico City. Second opinion. (In Spanish, “Evaluación del Bono Verde de la Ciudad de México 2018. Segunda Opinión.”). October 31, 2018. Available at (accessed Sep 5, 2023) http://www.data.sedema.cdmx.gob.mx/cambioclimaticocdmx/images/biblioteca_cc/Reporte-Segunda-Opinion-Bono-Verde-2018.pdf

Carbon Trust. Monitoring and evaluation of the green component of the 2017 sustainable bond of Mexico City (In Spanish, “Seguimiento y Evaluación del Componente Verde del Bono Sustentable 2017 de la CDMX.”). November 20, 2018. Available at (accessed Sep 5, 2023) http://www.data.sedema.cdmx.gob.mx/cambioclimaticocdmx/images/biblioteca_cc/Primer_reporte_de_seguimiento_Bono_Verde_2017.pdf